mississippi income tax brackets

2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

How To Create An Income Tax Calculator In Excel Youtube

The 5 tax on remaining income will drop to 47 for 2023 then 44 for 2025 and 4 starting in 2026.

. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. 2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The following three years the 5 bracket will be reduced to 4.

Ad Compare Your 2022 Tax Bracket vs. Mississippi has enjoyed robust tax collections the past several months partly because of increased federal. Starting next year the 4 income tax bracket will be eliminated.

Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023. Mississippi State Personal Income Tax Rates and Thresholds in. Ad Access IRS Tax Forms.

After the first year the tax-free income levels would be 18300 for a single person and 36600 for a married couple lawmakers. Read the Mississippi income tax tables for Single filers published inside the Form 80-105 Instructions booklet for more information. Similar to the personal income tax businesses must file a.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Mississippi State Personal Income Tax Rates and Thresholds in. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

Discover Helpful Information And Resources On Taxes From AARP. Mississippis state income tax is fairly straightforward. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent.

3 rows Mississippis income tax brackets were last changed four years prior to 2020 for tax year. Starting in 2023 the four percent income tax bracket will be eliminated. All other income tax returns P.

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Your 2021 Tax Bracket To See Whats Been Adjusted. Box 23058 Jackson MS 39225-3058.

Employees who earn more than 10000 a year will hit the top bracket. Mississippi Corporate Income Tax Brackets Tax Bracket gross taxable income Tax Rate 0 3000. If you are receiving a refund PO.

In the following three years the 5 bracket will be reduced to. Box 23050 Jackson MS 39225-3050. 4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax.

Eliminate the states 4 tax bracket on peoples first 5000 of taxable income starting 2023. Mississippi also has a 400 to 500 percent corporate income tax rate. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. For a married couple making 80000 that would be 834 a year. After the first year the tax-free income levels will be 18300 for a single person and 36600 for a married couple lawmakers said.

The tax brackets are the same for all filing statuses. The following three years the 5 bracket would be reduced to 4. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Mississippi personal income tax rates. Any income over 10000 would be taxes at the highest rate of 5. If youre married filing taxes jointly theres a.

3 rows Mississippi state income tax rate table for the 2022 - 2023 filing season has three income. No cities within Mississippi charge any additional municipal income taxes so its pretty simple to calculate this part of your. Mississippi Income Taxes.

The graduated income tax rate is. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. Complete Edit or Print Tax Forms Instantly.

The Mississippi corporate income tax is the business equivalent of the Mississippi personal income tax and is based on a bracketed tax system. This means that these brackets applied to all income earned in 2018 and the tax return that uses these tax rates was due in April 2019. This income tax calculator can help estimate your average income tax rate and your salary after tax.

Single married filing separate. There are just three income tax brackets and the tax rates range from 0 to 5. 0 on the first 2000 of taxable income 3 on the next 3000 of taxable income 4 on the next 5000 of taxable income.

California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133.

Mississippi Senate Income Tax Cut Plan Makes Its Way Through Finance Committee Mississippi Politics And News Y All Politics

Taxprof Blog In 2022 Infographic Map Real Estate Infographic Map

Timeforchange Arizona Rfaz Ld24 Ld24dem Azdem Azdems Community Bestofphoenix Melrosedistrictphx Melrosephx V Kentucky Time For Change West Virginia

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

Where Should I Retire Infographic Blog Boca Raton Fort Lauderdale Homes Best Places To Retire Real Estate Infographic House Prices

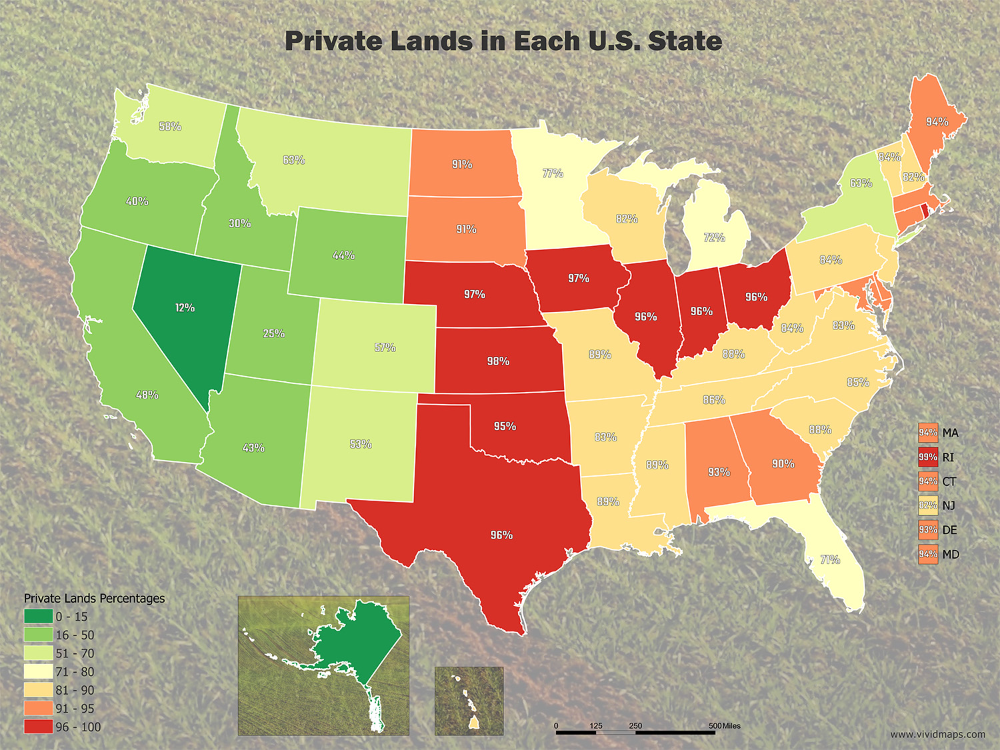

Value Of Private Land In The U S Mapped Vivid Maps Places In America Grand Canyon National Park Us Map

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Cost Of Living

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Graph Showing How Much Minimum Wage Earners In Each State Would Pay If A Single Co Pay Took As Many Hours To Earn As A Co Pa Up Government Doctor Visit Medical

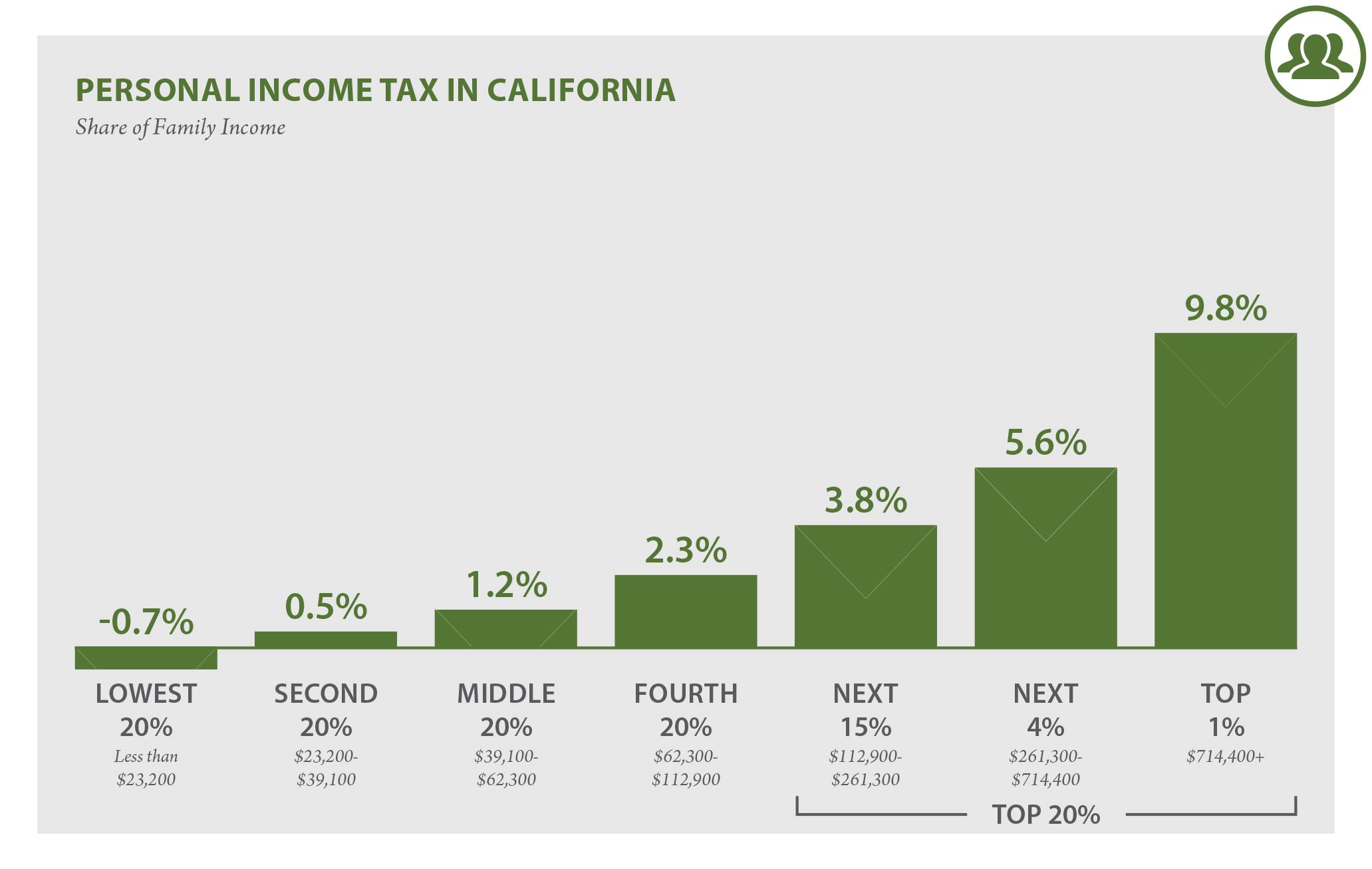

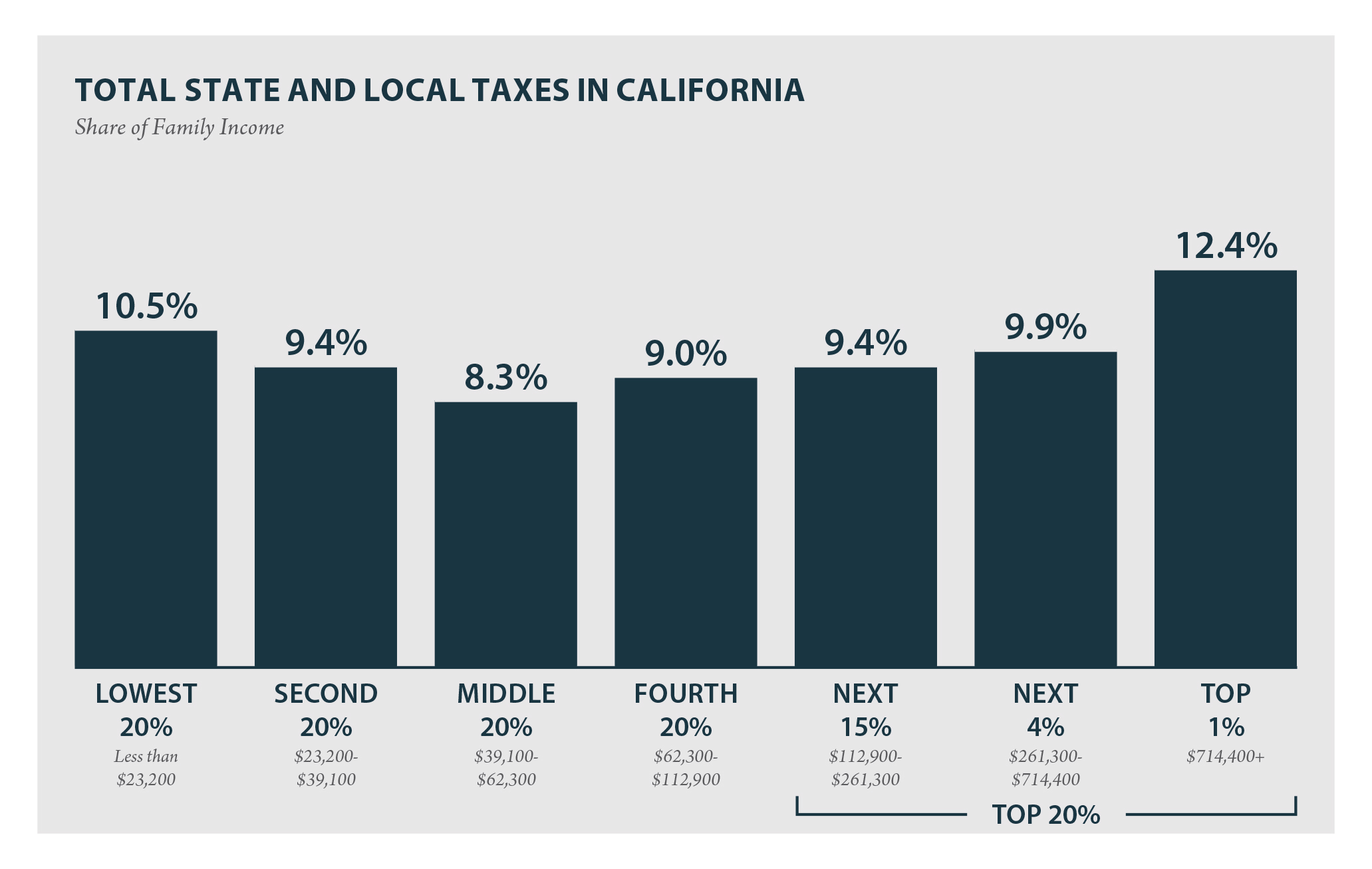

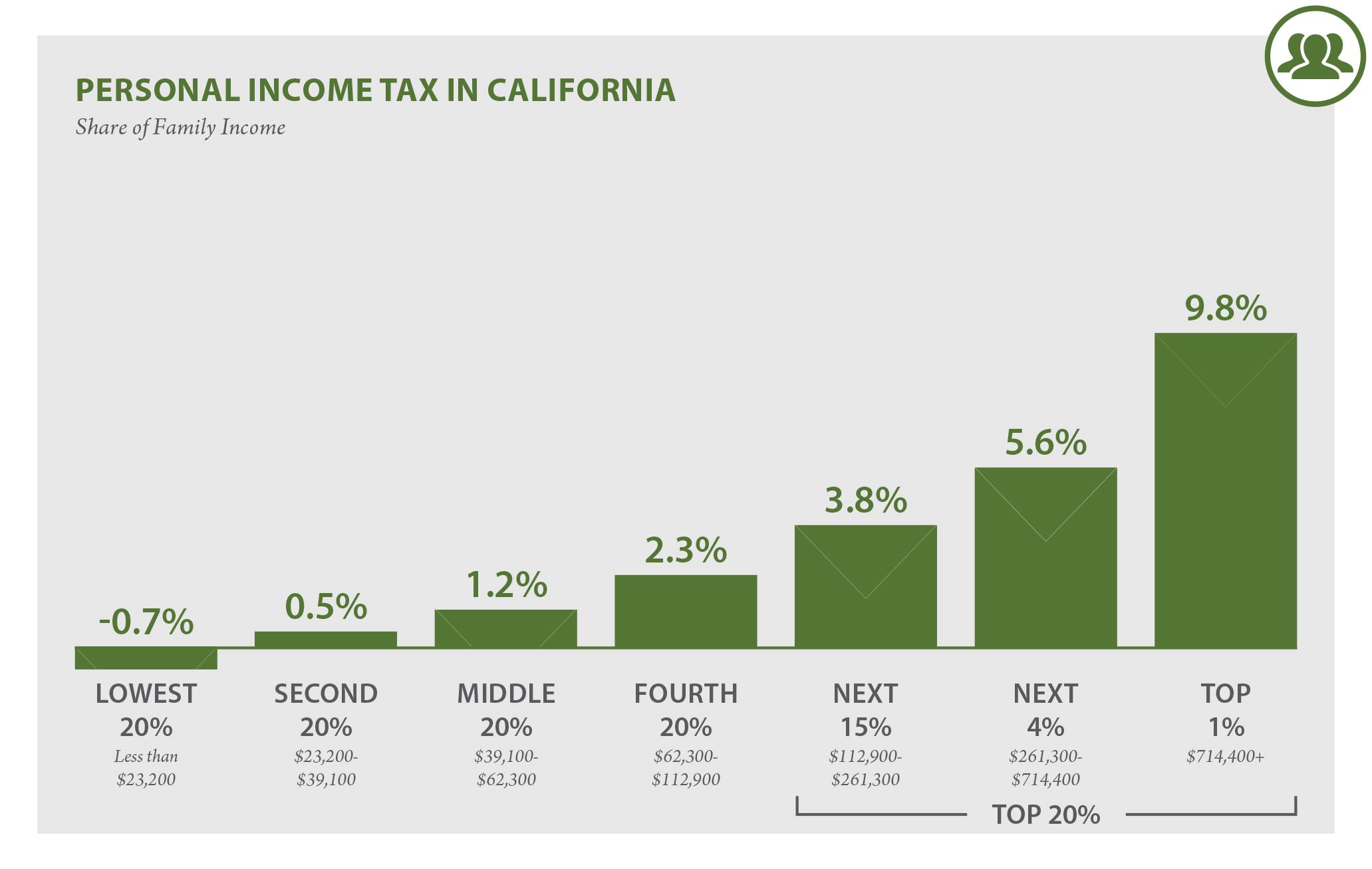

California Who Pays 6th Edition Itep

How High Are Corporate Income Tax Rates In Your State Tax Foundation Of Hawaii

California Who Pays 6th Edition Itep

We Used Data And Science To Determine The Whitest States In America States In America America States

Experts Discuss Bill That Would Eliminate Mississippi S State Income Tax Wjtv

Full Page Layout For Kiplingers Personal Finance Magazine Illustration Doodlesandstuff Andrewjoyce Illustrator Illustrated Drawing Procre イラスト イラストレーター